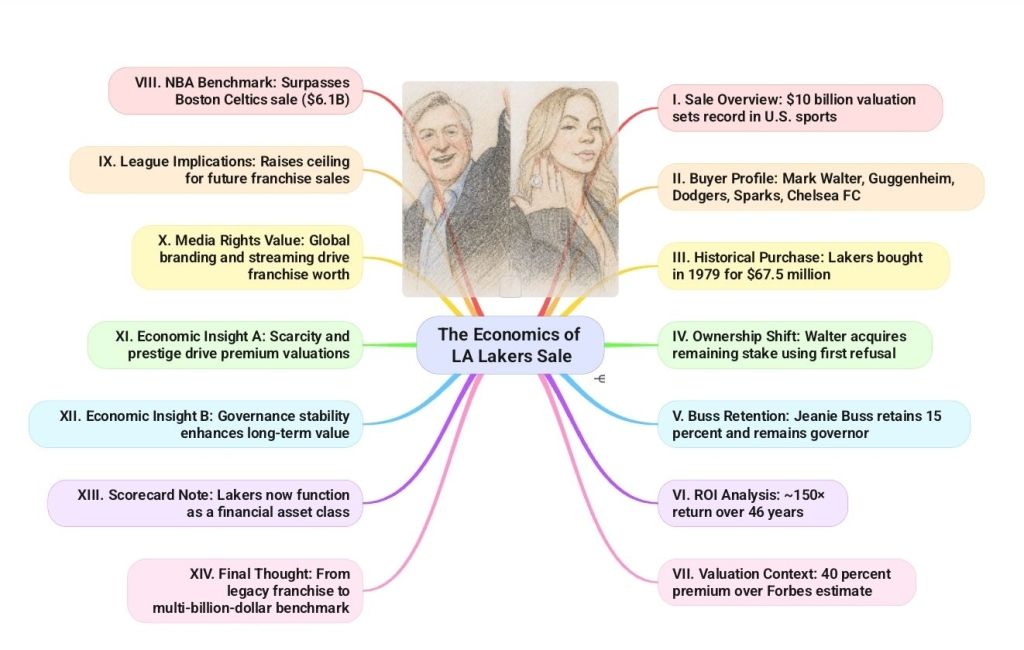

In the expansive ocean of American sports franchises, the Los Angeles Lakers have always loomed large—a flagship woven in gold thread, its sails stitched with banners. But even iconic vessels must, at times, consider the weather. The recent sale of a 66% stake in the Lakers to Mark Walter and Guggenheim Partners, at a record $10 billion valuation, signals not a surrender, but a savvy repositioning—one that preserves legacy while scaling for the future.

🎯 From Family Legacy to Strategic Partnership

In 1979, Dr. Jerry Buss acquired the Lakers for $67.5 million. It was, at the time, a bold gamble on a basketball team and a belief in Los Angeles as a global sports city. Nearly five decades later, that wager has yielded one of the most valuable franchises in all of professional athletics.

Jeanie Buss’s decision to sell a majority stake, while retaining an estimated 40% ownership and her role as governor, reflects both emotional fidelity and financial precision. It is not an exit. It is a realignment. By sharing the helm, the Buss family preserves its name in the legacy while releasing itself from the burden of navigating alone in increasingly turbulent economic waters.

🧠 Why 66% to Walter, Not 100%?

This wasn’t a full sale—it was a strategic divestment. Selling a 66% stake gave the Buss family access to liquidity and diversification without relinquishing their identity. They now share the risk, but also remain in position to share the rewards.

Walter, who previously acquired a significant stake from AEG in 2021, exercised his right of first refusal to consolidate control. What makes this move unique is that while Walter gains operational influence, Jeanie retains cultural stewardship—a rare balance of governance and grace.

🌍 Mark Walter’s Playbook: From Ownership to Orchestration

Walter does not merely collect franchises—he calibrates them. His portfolio includes the Dodgers, Sparks, and Chelsea FC, and he brings with him a philosophy grounded in sustainability, data intelligence, infrastructure development, and long-view branding.

Under Walter’s stewardship, the Dodgers secured World Series titles in 2020 and 2024. More importantly, they became a model of market synergy: blending heritage with innovation, drawing talent not just to the team, but to the culture.

His entry into the Lakers’ leadership isn’t just about capital—it’s about ecosystem. One can reasonably anticipate increased investment in player development, sports science, analytics, and international expansion.

📈 Implications for the NBA and Beyond

Valuation Benchmark: The $10 billion price tag sets a new ceiling, eclipsing the $6.1 billion valuation of the Celtics earlier this year.

Scarcity Premium: NBA franchises are few, and truly elite brands are fewer still. When one comes to market, the bidding doesn’t reflect value—it reflects desire.

Governance Harmony: Jeanie Buss remains as governor, preserving continuity in the franchise’s voice, values, and visibility. Magic Johnson and other key voices have praised this continuity as vital to both league politics and fan trust.

Media Rights Power: The Lakers’ long-term deal with Spectrum, worth over $5 billion through 2041, isn’t just income—it’s insulation. It secures predictable revenue while the league renegotiates future streaming and global rights deals.

🔍 A Broader Economic Lens

The Buss family has achieved something rare: they’ve realized generational wealth while retaining generational purpose. Many legacy owners either cling too long or cash out entirely. This deal allows them to step back just enough to breathe, but not so far that they lose the view.

Walter, for his part, gets to apply his operational genius to a cultural icon. He doesn’t inherit dysfunction. He inherits greatness—and the burden of extending it.

For the NBA, the implications are both immediate and existential. Franchises are no longer merely civic institutions. They are asset classes. Tradable, expandable, and capable of serving as global platforms for media, commerce, and influence.

🧘 From Small Ship to Strategic Sail

The Lakers were, in some sense, a small ship in an expanding ocean. The Buss family held the wheel with courage, tradition, and deep affection—but navigating the demands of global sports, media disruption, and billion-dollar payrolls can make even a seasoned captain long for stronger sails.

Now, they have them.

This is not abdication—it is augmentation. The Lakers, long adored for their mystique, now step into their next act with ballast beneath them, wind at their back, and still—with Jeanie aboard—a hand on the wheel.

📝 Scorecard Takeaways

1. $10 billion valuation sets a new high-water mark for sports franchises.

2. Partial retention (approx. 40%) by Buss family ensures cultural continuity.

3. Walter’s operational strategy brings experience, synergy, and long-term vision.

4. Local media deal continues to drive economic resilience.

5. NBA evolution: Franchises are no longer mom-and-pop dynasties. They are sovereign financial entities.

The story of this sale is not the end of a dynasty—it’s the deliberate expansion of one. It is what happens when legacy has the wisdom to make room for leverage.

The Lakers have not fallen. They have risen—differently.

And they are not alone.

Leave a comment